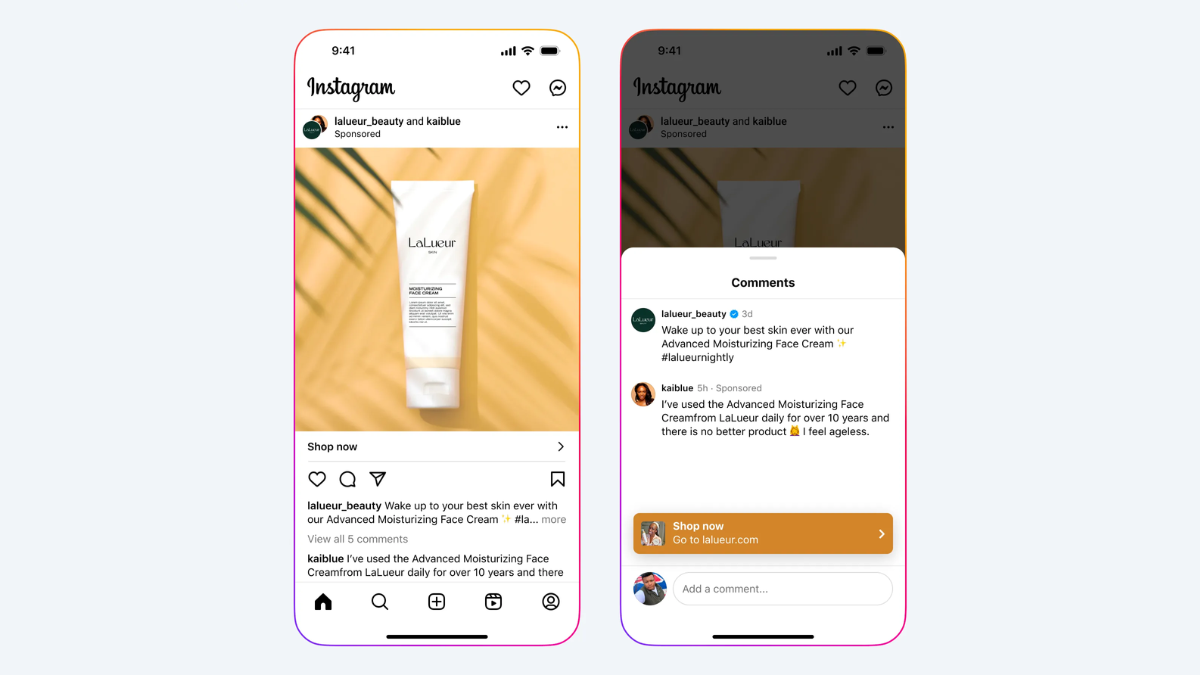

Instagram rolls out testimonials which lets creators get paid by written endorsments

Instagram on thuresday announced a new avenue for creators to earn money through partnership advertisements called Called Testimonals. It is a type of content which a brand posts in collaboration with a creather for the promotion of a product or service. Such ads are featured on the creator\’s instagram handle in the form of videos or written-only text. The social media platform says its new ad format follows a text-only medium which can be stacked on top of existing deals with brands.

Testimonials on Instagram

In a blog postMeta Detailed Its New Partnership Ad Format. Testimonials are said to be short, text-only endorsments, which the company says, are a cuick avenue to earn money. Creators can Write a short message under 125 characters related to the brand\’s campaign or product and send it to them, which will have attacked to the relevant ad. They will appear as comments on the particular post with a Sponsored Tag, Pinned at the Top, Enabling them to self-definitive as paid promoters.

The reason behind this move? Meta Claims 40 Percent of Instagram users consider recommendations by creators when shopping. With partnership ads, creators are said to have the option to charge more money while also expanding their reach on the social media platform.

However, the performance metrics will be limited to the brand\’s account, meaning creaters will have to ask them to share the content performance. As per the platform, this will enable them to optimise their content for future deals.

Other new features

Instagram has rolled out Several new features lately. This includes new options in DMS which enable users to translate messages in different languages in private chats, schedule messages, and share music previews with others with other. Further, they can now also pin specific chats on the instant messaging platform.

The update also makes it Easier for users to invite others to group chats. They can create a QR Code of a Specific Group Chat and Show it toers, who can scan it and join the chat, instead of having to add them individually.